Compensation has the same meaning for purposes of the payroll expense tax as it does for the Washington State Family and Medical Leave program. Compensation includes all payments for personal services, including commissions and bonuses and the cash value of all earnings paid in any medium other than cash. If an employer is allowed the maximum credit of 5.4%, then the federal unemployment tax rate will be 0.6%.

In the third step of processing https://www.bookstime.com/articles/what-are-consolidated-financial-statementss, employers need to add all payroll deductions and taxes, if any, to get a total amount. We know that employer payroll costs represent the total sum of money an employer pays their employees to compensate for labour. However, this still begs the question, what makes up this total sum of funds? Payroll costs can be broken down into smaller segments, such as employee benefits, tax deductions, CPP/QPP contributions, and EI premiums.

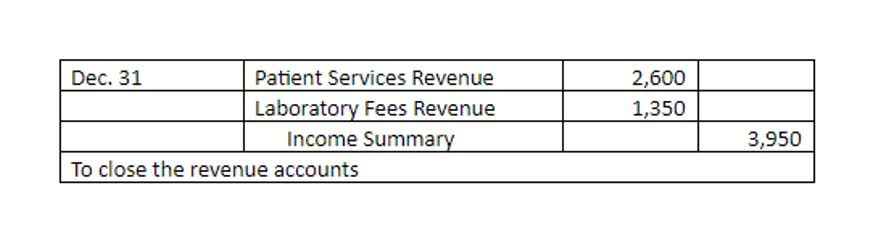

How to record payroll journal entries: Types and examples

You’ll have to file the T4 information return and distribute the slips to your team. Next, you must pay remittances to the CRA electronically or via cheque. Be sure the CRA receives these on or before the 15th of the month after you’ve made the deductions.

- You’ll want to consult an accountant or invest in full-service payroll software to feel completely confident that you’re paying employees correctly.

- As a result of these escalating costs, most companies now require employees to pay a portion of the premium cost; this amount is usually collected by means of employee-directed payroll withholding.

- As a business owner, you’re used to learning new things and making do with what you have.

- Benefits

Determine the benefits that you will offer employees, such as health insurance, pension plans, child care benefits and paid leave. - If your employees know that there’s a professional making sure they’re paid what they’re owed on time, it could go a long way toward gaining or keeping their trust in you.

Director’s Rule provides information and examples to determine whether your business is subject to the Payroll Expense Tax and how to calculate your tax payment. If the employer pays the insurance premium in advance, a current asset such as Prepaid Insurance is used. The account balance will be reduced and Worker Compensation Insurance Expense will increase as the employees work. The employer’s share of Medicare taxes is recorded as an expense and as an additional current liability until the amounts are remitted.

Is this a tax on the employee?

This accounting method does not post expenses based on cash outflows. The deductions which must be taken from wages include Income tax, the Medicare levy and sometimes also loan payroll expense repayment amounts. The employee’s details on the Tax File Number (TFN) declaration form in conjunction with the income tax thresholds determine how much should be withheld.

- Payroll deduction errors can lead to fines and penalties from the IRS, it’s important to monitor your processes.

- On a small scale, payroll isn’t very complicated, but once your business grows, handling payroll yourself becomes much more challenging.

- If you require any further information or assistance regarding editing payroll accounts and generating payroll reports, please feel free to ask.

- Everyone makes mistakes, and mistakes can occur when it comes to making payroll remittances.

- They’re the entries you’ll find before others within a general ledger that document a transaction.

- Payroll accounting lets you keep track of the cost of each employee.

Each of these options has distinct advantages and disadvantages as well as their own costs that you should think about as you look for ways to make paying an employee more efficient and less costly. Individual or team benefits might include compensation for someone’s work in addition to the money they routinely receive. These benefits could include a retirement plan, organization shares, or insurance policies. Our partners cannot pay us to guarantee favorable reviews of their products or services. Whether it be rent, equipment, or office supplies, small business owners are no strangers to expenses.